Should sin tax be excluded from consolidated accounts?

In 1965, the government gave a licence for casino operations in Genting Highlands. Three years later, the first four-digit lottery licence was awarded to a private company which is now known as Magnum Bhd.

The Totalisator Board through the turf clubs had operated a three-digit lottery before it was privatised.

The government also allowed the setting up of Sports Toto and proceeds were to be used for sports activities in 1969. However, in 1985, it was privatised and it is not immediately known if part of Sports Toto’s profits continues to go into sports.

In 1962, Mohammed Khir Johari owned the first brewery – Malayan Breweries Ltd in Kuala Lumpur. In 1966, then prime minister Tunku Abdul Rahman launched the opening of the Guinness Brewery in Sungei Way, Selangor. In 1971, the prime minister of the day Abdul Razak Hussein officially opened the Carlsberg Breweries in Shah Alam.

Over the years, the “sin tax” collected from both the breweries and the lottery operators run into hundreds of billions of ringgit. This does not include the excise duties imposed on imported beer and hard liquor, which too would run into billions.

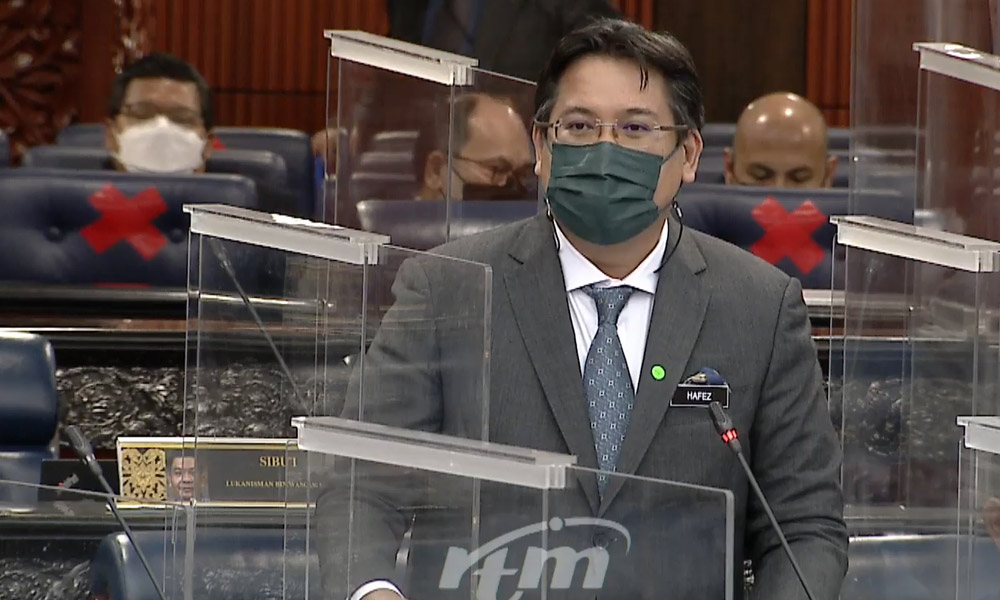

Deputy Finance Minister II Yamani Hafez Musa told Parliament that the excise tax revenue from hard liquor is about RM1.68 billion on average every year. But that does not include the taxes paid by breweries. And with 20 percent tax paid by 4D punters, that would be several billions more.

Then again, it does not include the corporate taxes paid by the entire supply chain, including the can and bottle manufacturers, the printers of the labels, the makers of the crates and even the transporters. Add the personal income tax paid by those employed in the supply chain, they add up to a tidy sum.

These taxes collected go into the consolidated fund and they go towards government expenditure as announced in the annual budget.

In Parliament last week, Steven Sim (DAP-Bukit Mertajam) suggested that the government separates the revenue from “sin taxes” on hard liquor and gambling from the government’s consolidated fund and only use it for the development of non-Muslims.

He mooted the idea citing the actions of PAS leaders who have been aggressive against alcohol and gambling, which have taxes imposed on them.

“I would like to ask... does the government plan to separate the tax revenue from alcohol and gambling – known as the sin tax – from the consolidated fund so that this money (from the sin tax) will only be used for non-Muslims?” Sim was quoted as saying by Malaysiakini.

Taking an average of RM10 billion from sin tax annually, it would mean the non-Muslim-Malay community need not have to resort to going out with begging bowls for development funds for their respective communities.

For the record, in Budget 2021, a paltry RM200 million was set aside for the Chinese community while RM145 million was allocated to the Indian community.

Under normal circumstances and when allocations are made on a need-basis, Sim’s idea would have been summarily dismissed without discussion.

Ordinarily, a country cannot have a dual taxation system – one for all and sundry, and another for goods and services not acceptable to one section of the population.

But considering how the Keluarga Malaysia concept has meandered to benefit just one community and the noises it makes against “arak and judi” (alcohol and gambling), it certainly needs serious attention.

But will those righteous people who continue to impose their values on others and trample rights tell the government to segregate the sin tax?

Yamani said PAS is purportedly concerned about this “sinful money” being used for Muslim people and for the development of Islam.

If PAS is of this view, it is up to its representatives in the cabinet to get sin tax to be maintained outside the consolidated fund and solely for the use and benefit of those who indulge in arak and judi! But then, how do they suggest filling the big hole caused by such an exclusion? - Mkini

R NADESWARAN says the policy of “let and let live” must prevail and religion should never be an equation in government or in governance. Comments: citizen.nades22@gmail.com

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

✍ Credit given to the original owner of this post : ☕ Malaysians Must Know the TRUTH

🌐 Hit This Link To Find Out More On Their Articles...🏄🏻♀️ Enjoy Surfing!

Post a Comment