As lockdown drags on, 1-month wage subsidy not enough, says MP

A one-month extension to the ongoing wage subsidy programme is not enough as the "total lockdown" has been extended, said Ipoh Timur MP Wong Kah Woh today.

"What is the government aiming to achieve with a one-month subsidy at the rate of RM600 for each employee when most SMEs (small and medium-sized enterprises) have to suspend operations for four weeks?

"It is clearly too little to save jobs," he said in a statement.

Wong said the solution is to reintroduce the same wage subsidy imposed last year when qualified companies could apply for subsidies of up to RM1,200 per employee for three months.

The latest extension of the wage subsidy scheme - Program Subsidi Upah 3.0 - was announced as part of the Pemerkasa Plus stimulus package.

This programme began in January when most companies could operate as normal, despite the imposition of the movement control order (MCO).

It involved a subsidy of RM600 to companies for each employee with a monthly salary of below RM4,000. To qualify, the company must show a drop in revenue of at least 30 percent.

For applicants that are not in the tourism or retail industry, the subsidy is only for one month of wages.

Under the current "total lockdown" period from June 1 to June 28, most businesses are forced to remain shuttered.

Wong said during the first "total lockdown" last year, the government arranged for a special relief facility worth RM5 billion to help businesses, but there is none this round.

"There is none under the current MCO. Is the government now telling the SMEs to close shop, which will have a direct consequence of jobs loss, after MCO?" asked Wong

He also urged the government to arrange for an automatic three-month bank loan moratorium for all businesses and also for those who are not in the T20 (top 20 percent of income earners) on an opt-out basis.

He argued that the move will not involve cost for the government or banks, because the interest accrued will only be deferred.

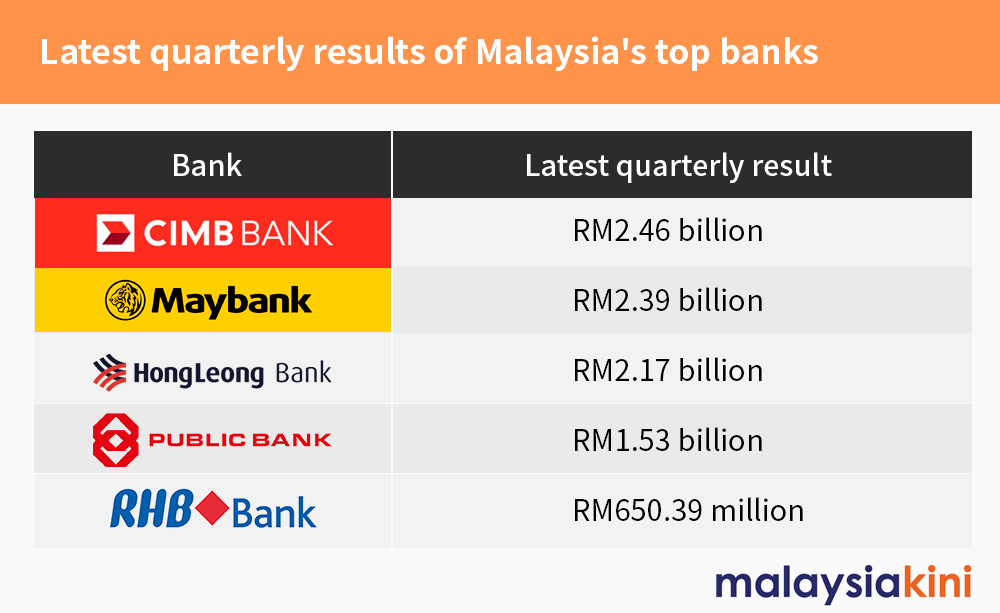

Unlike most businesses, banks did relatively well during the pandemic. Most of Malaysia's local banks reported healthy profits during the first quarter of this year.

Finance Minister Tengku Zafrul Abdul Aziz, a former top executive in the banking sector, has been unsympathetic to pleas for a blanket loan moratorium.

He argued that a moratorium would entail compensations and reduce the earnings of public funds. He also argued that forcing banks to do so would erode confidence in investors.

Yesterday, a coalition of business groups known as Moratorium Untuk Rakyat urged Putrajaya to impose an automatic bank loan repayment moratorium on an opt-out basis until Dec 31, or when herd immunity is reached - whichever comes later.

They argued that banks were bailed out with government funds before and they have earned billions over the past three years. - Mkini

✍ Credit given to the original owner of this post : ☕ Malaysians Must Know the TRUTH

🌐 Hit This Link To Find Out More On Their Articles...🏄🏻♀️ Enjoy Surfing!

Post a Comment