The Rise And Fall Of Yahoo – If Only They Hadn’t Screwed Up

Yahoo has finally sold itself away to Verizon Communications for merely US$4.83 billion. Only time will tell if the purchase is a great deal, or a waste of money. Verizon, America’s biggest wireless company, plans to merge Yahoo with AOL, a company it bought last year for a cool US$4.4 billion – cash.

Clearly, AOL hasn’t been working well for Verizon. The video contents from AOL are not able to attract billions of dollars in ads-selling, as what Verizon was betting. They need more contents. Verizon decided to pair AOL and Yahoo together, both known for their dot-com rise and fall, with a combination acquisition dollar amounting to US$9.23 billion.

Financial and technology analysts are scratching their heads – which sexy part of Yahoo that had attracted Verizon? Like it or not, the ailing dinosaur is still a surprisingly “popular content company” drawing roughly 1 billion users every month to its search engine, email portal, news sites, and services like Flickr and Tumblr.

Valued at roughly US$222 billion (£168 billion; RM900 billion), Verizon is one of the 15 largest companies in the country by sales. Annual revenues exceed $130 billion and the work force is 160,000. To burn close to US$10 billion on AOL and Yahoo is like losing some loose change to Verizon. It badly needs a growth story.

Verizon plans to challenge Google’s and Facebook’s dominance in online advertising. With Facebook and Google taking an estimated 78 cents of every new digital dollar spent, AOL holds just 1.8% of the US$69 billion digital ad market, while Yahoo’s share is about 3.4%. Therefore, even if Verizon captured just 2% more of the market, that would add additional US$1.4 billion – in US alone.

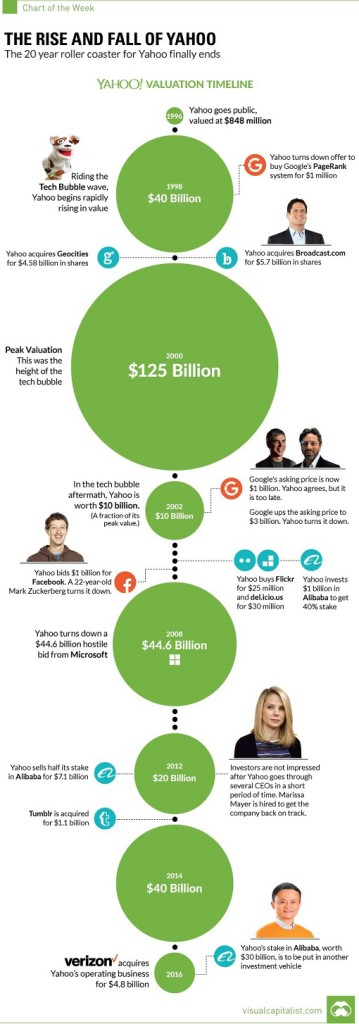

Frankly, Yahoo is more desperate to sell than Verizon to buy. In fact, the sale of Yahoo was an insult to the brand which at its peak in January 2000 was valued at more than US$125 billion. Founded in 1994, Yahoo was once the tech world’s brightest star, but it “fell behind the fast-moving internet economy it helped created.”

Yahoo had done a terrible job in acquisitions. Its biggest blunder was turning down an offer to buy Google’s search engine algorithm in 1998. The then-young Stanford Ph.D. students – Larry Page and Sergey Brin – wanted to sell the PageRank they created for merely 1-million US dollar. Short-sighted Yahoo was afraid that Google’s search engine would take people away from Yahoo’s website.

Spooked by competitors such as now-defunct Excite, AltaVista and Infoseek, Yahoo splashed a staggering US$4.58 billion instead to buy GeoCities in January 1999. Ten years later in 2009, GeoCities shut down for business. Amusingly, GeoCities Japan version of the service is still available until today.

The same year Yahoo purchased GeoCities, it also bought Broadcast.com for US$5.7 billion. The Internet radio company has since been closed, but not before making Broadcast.com co-founder Mark Cuban very rich. Yahoo actually paid over US$10,000 per user for Broadcast.com, a freaking dumb decision by today’s value.

Second opportunity knocks on Yahoo’s door. Google was willing to be acquired but at 1,000 times the initial offer in 1998. Their asking price: US$1 billion. That was in 2002 in the aftermath of tech bubble where Yahoo’s valuation tumbled from US$125 billion to just US$10 billion. Yahoo CEO Terry Semel laughed at Larry Page and Sergey Brin’s asking price.

Later, Semel reluctantly agreed to the price but the Google founders decided to up their price to US$3 billion. Terry Semel – a supposedly legendary Hollywood dealmaker but a guy who didn’t even use email – refused to pay US$3 billion even though his advisers told him that Google was probably worth at least US$5 billion.

Terry thought Google wasn’t worth US$5 billion because Google’s revenue stood at a measly US$240 million a year, whereas Yahoo’s was about US$837 million. Today, Yahoo’s market capitalization is worth US$37 billion (primarily due to Alibaba’s 40% stake) but Google Alphabet is worth more than 14 times at a whopping US$530 billion.

Roughly the same time, Yahoo bids US$1 billion for Facebook but a 22-year-old Mark Zuckerberg turned down the offer. If only Yahoo had put in some effort and pro-actively up the offer price by 20% to US$1.2 billion, shareholders of Facebook could have forced Zuckerberg to sell. After all, if Yahoo was willing to pay US$4.58 billion for GeoCities, US$1.2 billion for Facebook seemed cheap.

When everything seems doom and gloom, Microsoft offered to buy Yahoo for US$44.6 billion, or even rumoured to go as high as US$50 billion in 2008. Yahoo resisted the hostile takeover and flirted with many other suitors in an attempt to “save” the company. Today, Yahoo is sold to Verizon for about 10% of what Microsoft was willing to pay (*grin*).

There have been too many missed opportunities and bad deals for Yahoo. It was like the world is working against the company. However, the only great deal it made was the investment in Alibaba, which is today worth US$30 billion. If only it had agreed to purchase Google at US$1 million or even US$1 billion, and splashed more cash to Facebook shareholders than they could count.

Other Articles That May Interest You …

- Zuckerberg The “BrainWasher” – Facebook Decides What News You Should Read

- Alibaba Buying SCMP – The World’s Most Profitable Newspaper – From Robert Kuok?

- Can You Guess 7 U.S. Tech Companies Founded After 1970, But Worth Above US$100 Billion?

- Beware!! Facebook Can Tell If You’re A “Narcissist” Or “Insecure”

- Revealed!! – What Bill Gates Would’ve Done If Microsoft Had Flopped

- Revealed – Why Facebook Mark Zuckerberg Wears The Same Shirt Every Day

- Security Tips From Edward Snowden – Get Rid Of Facebook, Google & Dropbox

- Alibaba Jack Ma Raising Money Via IPO, But This Guy’s Raising Money Via Girlfriend Rental

- Facebook – From Stealing Idea to Cheating Investors?

from FinanceTwitter http://www.financetwitter.com/2016/08/the-rise-and-fall-of-yahoo-if-only-they-had-not-screwed-up.html

Post a Comment