PM: Gov't mulls new taxes to reduce inherited debt

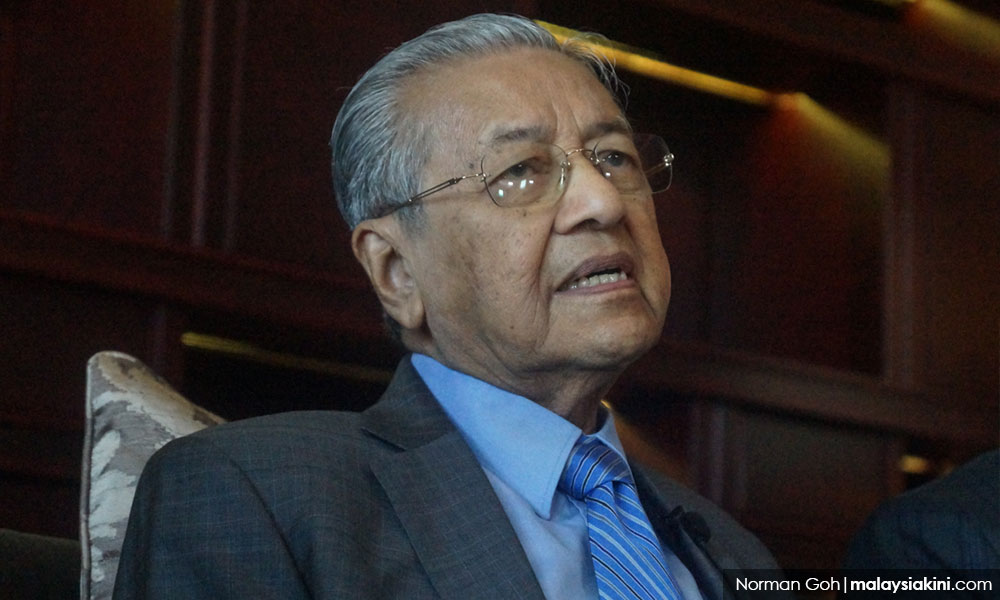

The government is looking at introducing new taxes as a source of additional income, according to Prime Minister Dr Mahathir Mohamad.

He said this is one of the measures considered to reduce the nation's debt inherited from the previous administration.

"It is a different form of tax but it will (indirectly) reduce the people's burden.

"That is the intention... to pay off the government's debts," he told reporters after delivering his opening speech at the “Malaysia A New Dawn” forum in Kuala Lumpur this morning.

In his speech earlier, Mahathir revealed that other measures being looked into include the possibility of selling government land or other assets.

"The previous government sold a lot of land to foreigners. I don't think that's good for us. But we can sell land to locals," he said.

He added that the additional income generated would help reduce the government's debts and spur future economic growth.

Mahathir also said the government must find alternative sources of income as it was saddled with bad investments which could not be traced.

"Now, we don't know where the money is so we have to find other sources of funds," he added.

Meanwhile, Mahathir also said the government would remain business friendly because "businesses create wealth."

"Government doesn't create wealth, the government simply taxes the wealth of the people. If we are nice to you, it is because we are looking at the 24 percent (corporate tax)," he quipped.

Stakeholders from various industries gathered for the one day conference organised by the Finance Ministry and shared their input on how to boost the country's economy. - Mkini

✍ Sumber Pautan : ☕ Malaysians Must Know the TRUTH

Kredit kepada pemilik laman asal dan sekira berminat untuk meneruskan bacaan sila klik link atau copy paste ke web server : https://ift.tt/2pK5rX5

(✿◠‿◠)✌ Mukah Pages : Pautan Viral Media Sensasi Tanpa Henti. Memuat-naik beraneka jenis artikel menarik setiap detik tanpa henti dari pelbagai sumber. Selamat membaca dan jangan lupa untuk 👍 Like & 💕 Share di media sosial anda!

Post a Comment