NAJIB 1MDB TRIAL - DAY 13: 1MDB subscribed additional US$1b notes from PetroSaudi - witness

KEY HIGHLIGHTS

- 1MDB subscribed additional US$1b notes from PetroSaudi - witness

- Joint venture company wouldn't cooperate with 1MDB - Shahrol

- Bakke resigned from 1MDB over joint venture dissatisfaction: witness

- 1MDB transferred US$700m to Good Star Ltd in Sept 2009

- 1MDB never inked any agreement with Good Star Ltd, says ex-CEO

- Witness: 1MDB board doubtful on PSI, but Najib ordered them to speed up

- Najib never asked if Argentina, Turkmenistan oil fields existed - witness

- Shahrol: 1MDB-PSI joint-venture dealings left to Casey Tang

- 1MDB-PetroSaudi JV idea conceived during yacht getaway in France

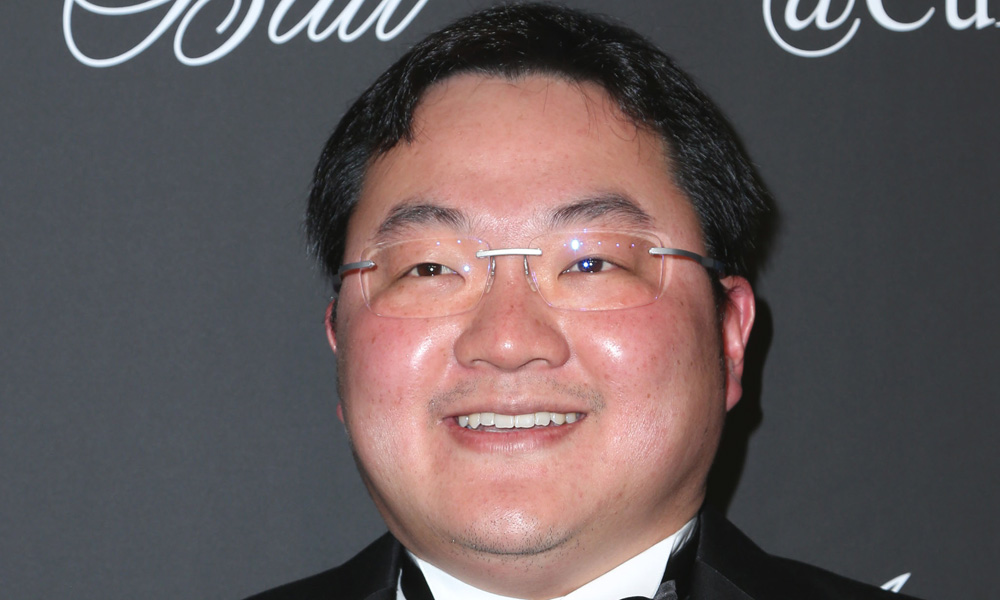

- Najib and Jho Low had a symbiotic relationship: witness

- Audit would've revealed US$700m went to Jho Low's company - Shahrol

- 1MDB CEO told by Jho Low no need to audit company in 2009

- Witness: Jho Low is 'far more effective' way to reach Najib

- Several names considered as TIA’s replacement

- Najib used MoF Inc minutes as shield against accusation: witness

- 1MDB money raised from RM5b bonds invested in PSI

- Shahrol appointed as 1MDB CEO by Najib

Thank you for following Malaysiakini's live report

Thank you for following our live report today.

4.30pm - The proceedings adjourn with the former 1MDB CEO Shahrol Azral Ibrahim Halmi stopping at page 129 of his 270-page Witness Statement.

The trial resumes at 9.30am tomorrow.

1MDB subscribed additional US$1b notes from PetroSaudi - witness

4.15pm - After 1MDB could not get cooperation from its joint-venture company with Petrosaudi, the sovereign wealth fund decided to terminate their 1MDB Petrosaudi Ltd (JV Co) agreement, the court hears.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that this decision was agreed by its board of directors (BOD) and the Finance Minister as 1MDB shareholder.

For the record, the finance minister then was Najib Abdul Razak, who was also the prime minister.

Shahrol says that the BOD and Najib gave formal approval to sell 1MDB's US$1bil shares in the JV Co through a directors' resolution dated March 22, 2010.

According to Shahrol, PSI had allegedly agreed to turn 1MDB's US$1bil investment into Murabaha notes worth US$1.2bil, which leaves 1MDB with a profit of US$200mil.

"However, the Murabaha subscription agreement also obliges 1MDB to subscribe to an additional US$1bil notes," he says.

Being queried by DPP Gopal Sri Ram what this meant to 1MDB, Shahrol testifies that it meant that Petrosaudi would have the ability to ask more money from 1MDB.

Gopal: Did that happen?

Shahrol: Yes.

Gopal: How much?

Shahrol: In several tranches, totalling US$830mil.

Joint venture company wouldn't cooperate with 1MDB - Shahrol

3.50pm - A former 1MDB CEO tells the court that he faced difficulties to get cooperation from 1MDB PetroSaudi Ltd, which was the joint-venture company 1MDB had set up with PetroSaudi.

Shahrol Azral Ibrahim Halmi says that between Oct 2009 and Feb 2010, he and then 1MDB executive director Casey Tang had tried to get information from 1MDB PetroSaudi Ltd for submission to auditor Ernst & Young.

However, according to him, they could not get enough information from the company as they could not get the cooperation of Patrick Mahony and Tarek Obaid.

"They didn’t have the slightest interest to entertain us and were more prone to communicate only with Jho Low," he testifies.

Shahrol says he had also contacted Jho Low to seek his assistance.

According to the witness, he had also requested Casey Tang to arrange for a 1MDB PetroSaudi Ltd board of directors meeting but this had never happened.

Shahrol says PSI, Jho Low and Casey Tang had then in early 2010 suggested to him to terminate the joint venture agreement.

Bakke resigned from 1MDB over joint venture dissatisfaction: witness

3.42pm - Bakke Salleh stepped down as 1MDB director on Oct 19, 2009, the sovereign wealth fund's former CEO testifies.

Shahrol Azral Ibrahim Halmi says the resignation followed Bakke's dissatisfaction with updates provided by the ninth witness in regards to the way the 1MDB-PetroSaudi joint venture was handled, especially in relation to the alleged diversion of US$700m from the venture.

"Not long after that, Bakke resigned as 1MDB director on Oct 19, 2009. I do not know the real reason for the resignation. But I can feel the possibility that he was dissatisfied with what happened in the joint venture process," Shahrol says.

1MDB transferred US$700m to Good Star Ltd in Sept 2009

3.10pm - The court hears from the former 1MDB CEO that the company transferred a total of US$1bil to two bank accounts on Sept 30, 2009 as an investment in a joint-venture with PetroSaudi.

According to Shahrol Azral Ibrahim Halmi, one of the accounts belonged to Good Star Ltd, which received US$700m. The remaining US$300m was transferred into an account belonging to the 1MDB-Petrosaudi joint-venture company itself.

The witness says that he was informed by Jho Low that the Good Star Ltd account belonged to Petrosaudi, and that the payment was for a cash advance made by Petrosaudi to their joint-venture company.

"This means that Petrosaudi Cayman was a subsidiary of Petrosaudi (PSI) and that Petrosaudi Cayman was in debt to PSI through assets worth over US$1.5bil.

"So, they would have to pay the debt because those assets had been made the joint venture company’s equities.

"I could accept the explanation by Jho Low as it made sense, and moreover the share certificate also showed that the joint venture company had already received the US$1bil that we (1MDB) injected through the two tranches," Shahrol testifies.

1MDB never inked any agreement with Good Star Ltd, says ex-CEO

2.53pm - 1MDB had never entered into any agreement with alleged Jho Low-linked Good Star Limited, the sovereign wealth fund's former CEO testifies.

Shahrol Azral Ibrahim Halmi says that during his tenure as 1MDB CEO, the fund has never entered into any agreement with Good Star Limited.

The ninth witness says that he was in the dark on a purported investment management agreement between 1MDB and Good Star Limited dated Sept 29, 2009.

He adds that he never ordered Casey Tang to sign any agreement with Good Star Limited.

"I also wish to confirm that in my whole tenure as 1MDB CEO, there has never been any transaction done (by 1MDB) with Good Star Limited.

"I also confirm that this agreement has never been tabled at any 1MDB board meeting. I confirm I had never seen this document," Shahrol says.

2.36pm - Proceedings resume after lunch break.

12.46pm - The court adjourns for lunch, proceedings will resume at 2.30pm.

Witness: 1MDB board doubtful on PSI but Najib ordered them to speed up

12.30pm - A former 1MDB CEO tells the court that then prime minister Najib Abdul Razak had called up the company's board of directors (BOD) chairperson, Bakke Salleh (below), before a BOD meeting on Sept 26, 2009.

Shahrol Azral Ibrahim Halmi testifies that Bakke, after ending the call with Najib, had told the meeting that the premier had ordered them to speed up the decision-making process and approve 1MDB’s joint-venture with Petrosaudi International.

According to him, Najib had given the order citing that the Saudi royal family would have a working visit to Malaysia, during which the joint-venture agreement would be signed.

He says the BOD, after hearing Najib's order, then felt that they should not delay the process any longer as not to humiliate the Malaysian government.

Shahrol says that he believed Najib had made the call under Jho Low's advice, as he had earlier told the businessperson of doubts raised by 1MDB BOD members on Petrosaudi during their earlier meeting.

"After the project paper on this joint-venture with PSI was presented by Casey Tang on Sept 18, 2009, Tan Sri Bakke and Tan Sri Azlan Zainol (1MDB director then) seemed not convinced with this investment.

"They were not confident if the investment we were about to do was with a real company owned by Saudi Arabia or not.

"They also queried on the breakdown of the joint-venture where 60 percent comes from PSI's oil assets. The board wanted to have a more in-depth understanding of the assets through independent valuation or site visit.

"Tan Sri Bakke even wanted a PSI representative to come personally to present the join-venture to the board," Shahrol testifies.

The witness says that he then informed Jho Low about this, and told the businessperson that the latter would have to do something, including attend the BOD meeting, to convince the board members of approving the joint-venture with PSI.

Shahrol says he, however, did not know about the idea for Najib to call Bakke, and believed that Jho Low was the one who asked Najib to do this.

Najib never asked if Argentina, Turkmenistan oil fields existed - witness

12.19pm - Then prime minister and 1MDB Board of Advisors chairperson Najib Abdul Razak never asked its then CEO Shahrol Azral Ibrahim Halmi whether there were really oil fields in Argentina and Turkmenistan, the court hears.

The ninth witness Shahrol tells lead DPP Gopal Sri Ram this during the examination-in-chief.

The lawyer asks Shahrol this question in relation to the witness testimony that one Edward L Morse was appointed by 1MDB to value its oil fields assets in the two countries, which was worth over US$1.5bil.

Gopal: As chairperson of the (1MDB) Board of Advisors, did the accused (Najib) instructed you to go and check whether the oil fields in Argentina and Turkmenistan existed?

Shahrol: No, he did not.

Shahrol: 1MDB-PSI joint-venture dealings left to Casey Tang

12.05pm - The former CEO of 1MDB says he handed over the responsibility of dealing with Petrosaudi International for their joint-venture to Casey Tang on Jho Low's suggestion.

Shahrol Azral Ibrahim Halmi testifies that 1MDB then had nobody else with the knowledge and experience in handling finances, including matters pertaining to fund-raising and corporate structure.

The witness says he also trusted Casey Tang, whom he described as being very close to Jho Low, as the person involved in 1MDB's precursor Terengganu Investment Authority (TIA) even before Shahrol joined the company, among other reasons.

Shahrol says he also believed that Jho Low was more comfortable with Casey handling the joint venture with Petrosaudi as they had known each other for a long time and Tang was more experienced in corporate matters.

1MDB-PetroSaudi JV idea conceived during yacht getaway in France

12pm - The court hears that the idea of a joint-venture between 1MDB and Petrosaudi International was conceived when Najib Abdul Razak was having a holiday together with Prince Turki Abdullah on a yacht (below) in Aug 2009.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that he was informed about this by Jho Low, who told him (Shahrol) that he was also there when the discussion happened.

"Jho Low also informed me that before the discussion, Datuk Seri Najib had met King Abdullah (of Saudi Arabia) and both leaders had agreed to form a joint venture worth US$2.5bil as investment by both countries."

Najib and Jho Low had a symbiotic relationship: witness

11.50am - Then prime minister Najib Abdul Razak and wanted businessperson Jho Low had a symbiotic relationship, former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies.

During examination-in-chief by lead DPP Gopal Sri Ram, the prosecution’s ninth witness says this is the impression in his mind on the duo's relationship between 2009 and 2010.

Gopal: What impression was in your mind of the accused (Najib) and Jho Low's relationship?

Shahrol: The relationship was symbiotic in the sense that Jho (Low) executed what Najib wanted and Najib's role was to approve decisions that are required not only by the company but also government machinery.

Audit would've revealed US$700m went to Jho Low's company - Shahrol

10.50am - An audit would have revealed that US$700mil from the US$1bil meant for a 1MDB-PetroSaudi joint venture was diverted to Jho Low's company Good Star Limited.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi tells this to lead DPP Gopal Sri Ram during the examination-in-chief.

Shahrol says that back in 2010, 1MDB's Board of Advisors made a decision that there was no need for due diligence or auditing by the Auditor-General on the sovereign wealth fund.

Gopal: What would an audit had revealed?

Shahrol: The audit at that point in time (2010) would have revealed that we invested US$1bil with Petro Saudi International, but that US$300mil went to the joint venture company (between 1MDB and PetroSaudi) while US$700mil went to another company purportedly owned by PSI, which is Good Star Limited.

Good Star was previously reported as allegedly owned by wanted businessperson Jho Low.

1MDB CEO told by Jho Low no need to audit company in 2009

10.40am - A former 1MDB CEO tells the court that he had written a letter to the then prime minister Najib Abdul Razak in Dec 2009, stating there was no necessity for an audit exercise to be conducted on the company.

Shahrol Azral Ibrahim Halmi testifies that he was advised to write the letter to Najib and copy it to the then Auditor-General Ambrin Buang by businessperson Low Taek Jho, or Jho Low.

According to Shahrol, prior to writing the letter, 1MDB management received information that the Minister of Finance Incorporated (MOF Inc) wanted due diligence to be performed on 1MDB following the transfer of its shares from the Terengganu state government to MOF Inc.

"As per the normal course of events, I updated Jho Low, and he reverted back to me saying that an audit or due diligence by the Audit Department could present a political risk to Datuk Seri Najib."

According to Shahrol, he then asked for Najib's instruction for the next course of action through Jho Low.

The witness says that he was later told there was no need for an audit exercise on 1MDB as the company has already appointed (accounting firm) Earnst and Young, and that an audit report will be submitted to MOF Inc once it is ready.

To a question by DPP Gopal Sri Ram, Shahrol testifies that after he sent the letter to Najib, there was no adverse reaction from the premier to challenge its content.

Witness: Jho Low is 'far more effective' way to reach Najib

10.30am - Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that it was "far more effective" for him to go through fugitive businessperson Low Taek Jho to reach then prime minister Najib Abdul Razak.

He testifies this in court when asked by DPP Gopal Sri Ram (above) to compare which way was more effective for him to get to the premier compared to Najib's then special officer Amhari Efendi Nazaruddin.

Gopal: You said that in order to access the accused, you either have to go through Jho Low or PMO officer Amhari?

Shahrol: Yes, (true) at the time.

Gopal: From your experience, which (way) proved more effective?

Shahrol: From my experience, Jho Low is far more effective.

Gopal: So you can get to the accused more effectively through Jho Low?

Shahrol: Yes.

This testimony by Shahrol comes as he had earlier told the court that he had no direct access to Najib back in 2009, and had to go through Jho Low or Amhari when he needed to reach the accused.

Several names considered as TIA’s replacement

10.25am - The court hears from a former CEO of 1MDB that several names were considered before the company changed its name from Terengganu Investment Authority.

Shahrol Azral Ibrahim Halmi says that among the other names deliberated as TIA's new name included MDB Wealth Berhad, Malaysia Development Berhad dan Malaysia Wealth and Capital Creation Berhad.

However, according to the witness, the names were prohibited by the Companies Commission as they are ‘controlled words’ (dikawal).

The company then received a letter from the then prime minister Najib Abdul Razak to register its name as 1Malaysia Development Berhad.

TIA's name was officially changed to 1MDB on Sept 25, 2009.

Najib used MoF Inc minutes as shield against accusation: witness

10.24am - Then premier Najib Abdul Razak used the minutes of a Minister of Finance Incorporated (MoF Inc) shareholders meeting to shield himself from accusation of misappropriation, the court hears.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that this was done through the MoF Inc shareholders minutes which gives power to the Terengganu Investment Authority (TIA) board to conduct large transactions.

TIA, which was acquired by the government through MoF Inc, later morphed into 1MDB.

“Now, after the revelation by the investigation into the misappropriation that took place in 1MDB, I understood that the minutes of this shareholder meeting was intentionally released by Najib at that time (Sept 16, 2009) to shield Najib from accusation of misappropriation and then put (the) responsibility on the TIA board of directors," Shahrol reads from his Witness Statement.

He says this is because two days later (Sept 18, 2009), there was a board meeting to discuss on the use of funds from the TIA bonds to enter a joint venture project with Petro Saudi, which was a company owned by Prince Turki and Tarek Obaid.

It had already been established in court yesterday that 1MDB had in 2009, raised RM4.396bil from the selling of RM5bil bonds, which Shahrol said the difference in the amount accounted for between RM100mil and RM200mil of fees to AmBank while the other between RM500mil and RM600mil accounted for the selling of bonds at a discounted price.

The witness also said yesterday he learned from police last year that the bonds were sold at a discounted price to two companies based in Singapore and Hong Kong that were linked to Jho Low (above).

1MDB money raised from RM5b bonds invested in PSI

10.10am - The court hears from a former 1MDB CEO that a huge part of the money raised from the selling of bonds in 2009 was spent on investment in Petrosaudi International.

Shahrol Azral Ibrahim Halmi testifies that 1MDB used US$1bil, which was approximately RM3.4bil according to the exchange rate then, to invest in PSI on Sept 30, 2009.

He says the balance of about RM1bil in the 1MDB account was then used to service interest payments, or coupon payments, for the RM5bil bonds.

Shahrol appointed as 1MDB CEO by Najib

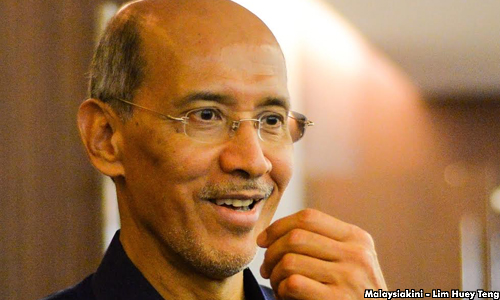

10am - Today’s hearing starts with former 1MDB CEO Shahrol Azral Ibrahim Halmi continuing his testimony by reading from his witness statement.

Shahrol, who served as the CEO from 2009 to 2013, testifies that he was officially appointed to the position by then prime minister Najib Abdul Razak, who was also chairperson of the 1MDB board of advisers, on Sept 17, 2009.

He says that the appointment by the prime minister was made in accordance to Article 68 of 1MDB's Memorandum and Articles of Association, which had been amended prior to that.

Shahrol says that the appointment was to signify that only the PM can appoint 1MDB board members and senior management.

9.53am - The trial resumes, with Najib entering the dock for the resumption of the prosecution’s examination-in-chief of former 1MDB CEO Shahrol Azral Ibrahim Halmi.

9.30am - Najib Abdul Razak enters the court and takes a seat at the front row of the public gallery to await proceedings to begin.

The prosecution's examination-in-chief of former 1MDB CEO Shahrol Azral Ibrahim Halmi enters the third day today.

With the ninth witness only having read up to page 57 of his 270-page witness statement yesterday, the examination-in-chief by lead prosecutor Gopal Sri Ram is still expected to be far from complete today.

As the 13th day of Najib Abdul Razak's RM2.28 billion 1MDB trial before Kuala Lumpur High Court judge Collin Lawrence Sequerah will resume around 9.30am this morning, Shahrol will continue where he left off yesterday.

Before proceedings were adjourned yesterday, Shahrol testified that Najib was the ultimate power in decision making within Terengganu Investment Authority (TIA) and later 1MDB, and his written permission was required, especially in terms of major investments, funds and national interest.

It is expected that the key witness will reveal explosive information on the goings-on with 1MDB during his testimony. - Mkini

✍ Credit given to the original owner of this post : ☕ Malaysians Must Know the TRUTH

🌐 Hit This Link To Find Out More On Their Articles...🏄🏻♀️ Enjoy Surfing!

Post a Comment