ANYTHING LONGER THAN 3 MONTHS – AND MALAYSIA’S ECONOMY WILL BE VERY BADLY HIT DUE TO CORONAVIRUS: ALREADY, THAI BAHT PLUNGES FROM BEST-PERFORMING CURRENCY TO WORST

ASIAN economies, including Malaysia, will be hit hard if the 2019 novel coronavirus epidemic lasts more than three months, said experts.

It has been six weeks since the outbreak began in the Chinese city of Wuhan. The virus has infected more than 34,000 people and killed some 700, most of them in China – the largest trading partner of many Asian countries.

Economist Soon Hoh Sing told The Malaysian Insight that Japan, South Korea, Taiwan, Hong Kong, the Philippines, Singapore, Malaysia and Thailand are expected to be affected if the outbreak lasts more than three months.

Demand for Chinese exports will slow down if the world’s second-largest economy experiences a downturn due to the virus.

China has a high share of private consumption, hence, an economic slide will slow demand for goods and services. Consumer spending, the largest driver of its economic growth, accounted for 76.2% of its gross domestic product growth in 2018.

The absence of Chinese citizens’ spending power will also be felt in Asian nations that are popular tourism destinations.

For Malaysia, the reduction in Chinese visitors due to the temporary suspension of visas will impact its tourism, catering and retail sectors.

“The tourism industry will be affected. Most tourists are from China, not the US. The Chinese have strong purchasing power,” said Soon.

If the epidemic persists, he said, Beijing might resort to foreign exchange control measures to prevent the weakening of the renminbi.

“This is a possibility, and will have a great impact on neighbouring countries. Therefore, I hope a vaccine will be found for the virus and the situation brought under control. Otherwise, the consequence will be bad.”

He said the outbreak and fears of infection will impact locals’ consumption patterns.

“People might not frequent shopping malls, cinemas and crowded places. I believe everyone will go out less, so this will have an impact on the retail industry.”

Philip Capital chief strategist Phua Lee Kerk predicts that China’s GDP will fall below 4% if the situation does not normalise within a year.

The country recorded a full-year GDP growth of 6.1% for 2019, its slowest growth since 1990.

However, Phua foresees the period of “economic pain” to end by April or May.

It is worth noting that China and the US entered the first phase of a trade deal on January 15, pausing their long-standing trade feud.

Phua expects a gradual recovery of economic activities by April or May, after the lockdown imposed to contain the virus is lifted and winter passes.

“According to previous patterns, pneumonia infections are more rampant in winter. And, they subside as the months go by.”

As long as the virus’ spread is contained, and once the peak period for infections is over after mid-February, the economy will recover, he said.

“The tourism and related industries will be the first to take a hit, because Chinese tourists are expected to come to Malaysia and stimulate the economy. The epidemic was unexpected.”

The manufacturing industry, on the other hand, will not be affected as much as it had likely prepared its stockpiles for Chinese New Year, which coincided with the outbreak.

“Wuhan is a hub for the automotive industry. Hence, the global automotive supply chain may also be affected,” said Phua.

He added that the current outbreak cannot be compared to the severe acute respiratory syndrome (SARS) crisis in 2003.

“At the time of the SARS epidemic, China’s economy was not so big. But now, it is ranked second in the world and it has greater importance.”

Soon concurred, saying the Chinese economy today is completely different than what it was in 2003.

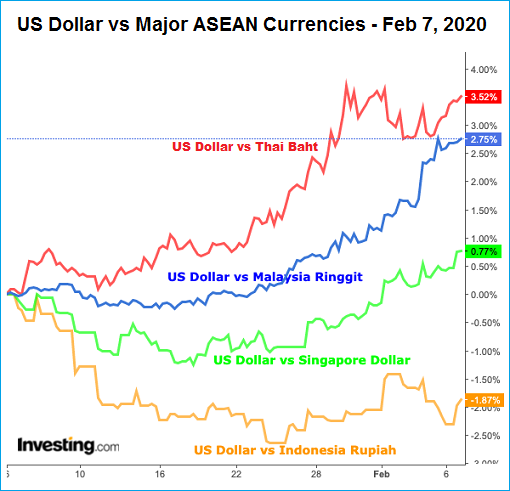

This Chart Shows How Coronavirus Has Turned Asia’s Best Performing Currency In 2019 To The Worst This Year

Thailand, Southeast Asia’s second-largest economy, was on cloud nine last year. Its currency – Thai Baht – was the champion not only among ASEAN countries, but also in Asia. In fact, the currency has been the best performing since 2018 (not only 2019). The currency appreciated a whopping 8% against the US dollar in 2019 alone. How did Thailand achieve it?

Thai’s solid economic fundamentals – a healthy current account surplus and substantial foreign reserves together with a hawkish central bank – was the secret recipe that lured capital inflows. Due to its stability, many considered the Baht as a safe haven currency among other emerging market currencies. Initially, the Bank of Thailand did not seem overly concerned about Baht’s strength.

The central bank’s foreign-cash pile stood at close to US$220 billion, the equivalent of more than 12 months of imports. Besides very low 0.3% inflation rate, Thailand also received a boost from its status as a gold trading hub. The US-China trade war and global economic uncertainty had driven the precious metal up by 17% (from US$1,300 to above US$1,500 per ounce).

The Bank of Thailand was happy over the currency’s appreciation, as a strong Baht can benefit Thai importers. But when the Baht continued its strength to the point that the country’s export-driven economy contracted for a fourth straight month in June 2019, the central bank had no choice but intervened. It was so bad that the country’s GDP growth was revised from 3.8% to 3.3% last year.

The trade war between China and the U.S., interestingly, was one of the factors contributing to the stability of the Thai currency. It became the preferred Asian hedge against global trade frictions. In other words, the worse the US-China trade war gets, the stronger the Thai Baht becomes. By October, 2019, the currency reached a 6-year high – the strongest level since May 2013.

The country was flushed with so much money that the government allowed – even encouraged – exporters to keep a larger amount of money overseas. Rules were changed to ease the outflows of the currency to stop the skyrocketing Thai Baht. The strong currency has made the country less competitive and worsened its export goods and tourism – two major drivers of Thailand’s economy.

By December 2019, however, the Asia’s best performing currency started to lose its shine. The US-China trade war appeared to end as tensions was easing between the world’s two biggest economies. The “Phase One” trade deal delivered a lethal blow to the Thai currency. The reversal of fortune saw the Baht climbed just 0.1% in December 2019 – making it the region’s worst-performing currency.

But a trade deal was not the only factor that affects the Thai currency. Murphy’s Law saw the unexpected outbreak of Coronavirus, creating a new threat to the currency. The Bank of Thailand had never imagined that a virus that originated from Wuhan, China, would reverse the Asia’s strongest currency in 2019 to the weakest in 2020 (as of today).

It’s barely two months into the New Year 2020, but the Thai Baht has lost as much as 4.1% against the U.S. dollar. In essence, it has lost about half of its 8% gains against the greenback recorded in 2019. To boost its economy, the central bank unexpectedly cut its interest rate for a third time in 6 months to an all-time low on Wednesday (Feb 5).

Effectively, with the exception of Japan, Thailand’s new interest rate – 1% – is the lowest in Asia. Its heavy reliance on Chinese trade and tourists has backfired. Tourism Authority of Thailand fears that that kingdom may see 2-million fewer Chinese tourists than last year’s 11-million. China is Thailand’s biggest source of tourists, contributing 28% of the total 39.8-million last year.

Here’s another angle to measure the importance of the tourism industry – it accounts for 12% of Thailand’s US$505 billion economy. The arrival of 39.8-million tourists in 2019 was equivalent to more than half of Thailand’s population. The Coronavirus confirmed cases has reached 25 (as of 5 Feb), including one person in serious condition, in the country.

Tourism revenue from China constitutes about 2.7% of Thailand’s GDP, while exports to China forms 6% of the country’s GDP. An estimated 108 billion to 220 billion Baht (US$3.47 billion to US$7.08 billion) of tourism revenue could be lost if the Coronavirus epidemic lasts for 3-6 months. The government has also slashed its 2020 economic growth forecast to 2.0%-2.5% from 2.5%-3.0%.

THE MALAYSIAN INSIGHT / FINANCE TWITTER

✍ Credit given to the original owner of this post : ☕ Malaysians Must Know the TRUTH

🌐 Hit This Link To Find Out More On Their Articles...🏄🏻♀️ Enjoy Surfing!

Post a Comment