Dollar Hits 14-Year High!! Ringgit Going Down Toilet Bowl – See You At Five

President-elect Donald Trump will be crowned as President of the United States on January 20, 2017. Nothing is going to change this fact unless he gets assassinated. But its wishful thinking if you hope the U.S. Intelligence and Secret Service will allow Trump gets killed under their nose. It might create bigger chaos if Trump is terminated.

Therefore, respect the system and the choice of the American people. Yeah, democracy is a bitch if the system doesn’t work in your favour. Violent demonstrations and demanding Trump to be either impeached or assassinated cannot deny the fact that Trump won the election fair and square. It’s called Brexit 2.0 and here’re 12 major reasons he wins against all odds.

However, some fragile and corrupted countries such as Malaysia will be facing bigger problems than Trump’s anti-Muslim foreign policy. Although the country’s prime minister – Najib Razak – tries to tell all and sundry that he’s one of Trump’s buddies, by showing off a photo of them golfing together, Trump would not actually care about Najib.

As we had written, Mr. Najib has a bigger problem than bootlicking the wrong horse such as Hillary Clinton and China. His 1MDB scandal will not disappear just because there’s a new president, and possibly a new U.S. Attorney General. Najib does not command the same influence possessed by Hillary Clinton where the FBI and US-DOJ would drop the lawsuits without a proper investigation.

Donald Trump raised his concern on the foul-mouthed Duterte when the Philippines president threatened the Philippines-US alliance. However, Trump didn’t mention the good-mannered Najib when the Malaysian prime minister threatened the Malaysia-US relationship. Chances are President-elect Trump doesn’t even know where the heck Malaysia is.

The long and short of the problem is the impact on currency. Trump’s victory is a huge issue to Najib administration because the new president is going to “Make America Great Again”. President Trump wants to rebuild roads, bridges, highways, tunnels, airports, schools, hospitals, railways and whatnot – an infrastructure investment worth a staggering US$1 trillion over 10 years.

Trump’s threat about scrapping the 1994 NAFTA is so real that both Canada and Mexico have voluntarily surrendered and are “willing to talk” about the unfair NAFTA trade agreement – even before Trump could threaten them again. Perhaps Canada and Mexico knew President Trump can invoke NAFTA’s Article 2205, without Congress’ approval, to scrap the trade agreement.

Nevertheless, the impact of Trump policies has already started before he is sworn in as the 45th President of the United States. The least Federal Reserve Chair Janet Yellen could do to keep her job is to raise interest rate in the next meeting in December. Yes, there’ll be at least a 25 basis point hike in the interest rate.

That’s why the Chinese Renminbi / Yuan have plunged to an 8-year low since December 2008. Although it’s unlikely for the time being, the prospect of Trump administration to label China a currency manipulator and slap tariffs on the nation’s exports has taken its toll on the Chinese currency.

HSBC Holdings Plc, UBS Group AG, Australia & New Zealand Banking Group Ltd. and Standard Chartered Plc have all lowered their Renminbi / Yuan forecasts – predicting that the currency will end this year at 6.9 per dollar. Heck, the Chinese authorities didn’t even care to intervene to defend their currency because it would be a futile battle against the market sentiment.

Today, the US dollar index hits 14-year high against a basket of currencies as a post-U.S. election sell-off resumed across global bond markets, boosting Treasury yields and attracting investors to U.S. currency. Everything that Trump administration plans to do will drive up inflation hence the interest rate hike.

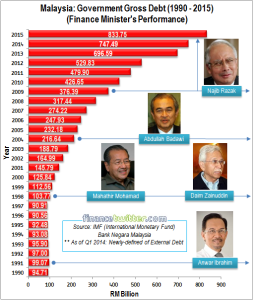

Now, Najib is facing 5 major problems. First, the US dollar is appreciating against Malaysia Ringgit. Second, the Chinese authorities are letting Renminbi / Yuan depreciates, triggering the prospect of currency devaluation war. Third, under Najib administration, the country has record external debt of RM833 billion as of end of 2015. Fourth, crude oil prices are still sagging.

Fifth, investors are still being spooked by 1MDB scandal which doesn’t seem to be going away. The crisis of confidence has suddenly reappeared on the investors’ screen when they’re facing a decision on whether to pull money out of Malaysia. Corruption is the favourite word now that Malaysian authorities have refused to cooperate with Switzerland’s Office of the Attorney-General with its probe into 1MDB.

The Ringgit hits RM4.40 to a US dollar moments ago before intervention by Bank Negara Malaysia (Central Bank) to protect the local currency. But frankly, for how long can the authorities intervene to prevent the Ringgit from going down the toilet bowl? How much reserve money is Najib administration willing to burn in its effort to stop Ringgit from going south?

Najib Razak and his chosen Governor of the Central Bank of Malaysia – Muhammad bin Ibrahim – are fighting a losing game against the global market. They are essentially fighting the appreciation of the US dollar as well as the depreciation of the Chinese Renminbi / Yuan at the same time. Suddenly, my US dollars kept under the pillow smell so nice.

If Ringgit’s plunge last year from RM3.50 to RM4.40 to a dollar was primarily due to 1MDB scandal and China’s currency devaluation, this round will be due to Trump’s presidency, China’s potential currency devaluation, servicing external debt and ongoing 1MDB scandal. And before those factors kick in, the Ringgit has already spiked from RM3.90 to RM4.40. The next stop is RM4.50, RM4.80 and could probably see you at five.

Other Articles That May Interest You …

- Betting The Wrong Horses – Why Trump Presidency Is Bad News To Najib Razak

- BREXIT 2.0!! – Here’re 12 Major Reasons Trump Wins Presidency, Against All Odds

- This Chart Shows Najib Regime Has Been Milking RON-95 Petro-Ringgit

- China (Secretly) “Devalues” Yuan – Global Recession Is Calling

- Here’re Why Ringgit Can Go Further – RM4.50 To US$1 – And Beyond

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

- Ringgit Is Toast – Here’re Proof Malaysia The First Asian To Hit Recession

from FinanceTwitter http://www.financetwitter.com/2016/11/dollar-hits-14-year-high-ringgit-going-down-toilet-bowl-see-you-at-five.html

Post a Comment