‘SUPERMAN’ GUAN ENG VS ‘THANOS’ NAJIB – WHO WILL WIN THE FINAL SHOWDOWN: MALAYSIAN TAXPAYERS GET A LIFELINE FROM UMNO’S EX-PIGGY BANK – BUT AFTER TAKING OUT RM54 BILLION, PETRONAS MIGHT NOT BE ABLE TO AFFORD IT

So as you probably know by now, the 2019 Budget was recently announced by the new govt, and boy oh boy did it give us a lot to talk about.

From the broken GE14 PTPTN promises to the additional funds for JAKIM, there were plenty of topics from the 2019 Budget that hit the headlines. However, amidst the protests over a tax on Netflix, you might have missed this headline:

Now why is this important? Well, it may just be that because of the govt’s actions to dip into Petronas’ piggy bank, that Petronas not only lost some money but also it’s reputation. We’ll explain more on that later, but first, let’s dissect why exactly the govt decided to take some funds from the oil and gas company

There’s an RM37 billion hole from unpaid tax returns (!)

So back in 2015, the Goods and Services Tax (GST) was implemented. GST is different from SST in the sense that itapplies the 6% at every stage of the supply chain. E.g. In a bowl of nasi lemak, the nuts, rice, ikan bilis are all taxed from the supplier, and then the mamak owner is also taxed 6% when it’s sold. THEORETICALLY though, the nasi lemak supplier CAN claim back some GST, because to some extent, the ikan bilis supplier has already paid a percentage of the GST.

For this reason, the government has a GST refund account for it. These are done AFTER all the GST has been collected from the various stages of each supply chain. The problem tho is that A LOT of these refunds were not made. Even in late 2015, there were reports of delayed GST refunds. However, it was only when Guan Eng and co took over Putrajaya that he made the revelation that the GST refund account only had RM1.48 billion in it when there should’ve been RM19.4 billion. This meant that there were plenty of companies who had not gotten their GST refunds when they should have.

Cilisos does not condone violence. Pls seek your refunds in more civil ways.

If that wasn’t bad enough, as it turns out, the Inland Revenue Board of Malaysia (IRB) also revealed that the Tax Refunds Trust Fund – something like govt bank account for income tax refunds – didn’t have enough money, meaning that some people have not been refunded their overpaid taxes since 2012!

And it’s not like it’s just two or three Malaysians who haven’t been paid either. When the story first broke, it was initially reported that there were RM16.05 billion in excess taxes that weren’t refunded. In more recent news articles tho, we saw that figure jump to around RM18 billion. Combine that with the amount of money needed for GST refunds, the total amount the govt owes companies and the public stands at a staggering RM37 billion.

Dramatic reenactment of Guan Eng and Tony Pua when they saw the tax refunds they owed

There is still some kinda good news for you if your tax refunds haven’t been paid. Guan Eng has decided to honour the debt, and that by repaying these tax refund debts, it could actually be beneficial for the country’s economy.

“We have to return the money as soon as we can … It is money that the government owes the taxpayers; otherwise, they could sue us … it has been two years. And the tax refund would help spur economic growth,” – Lim Guan Eng, as quoted by The Edge Markets

But wait… where the heck are we going to find RM37billion!?

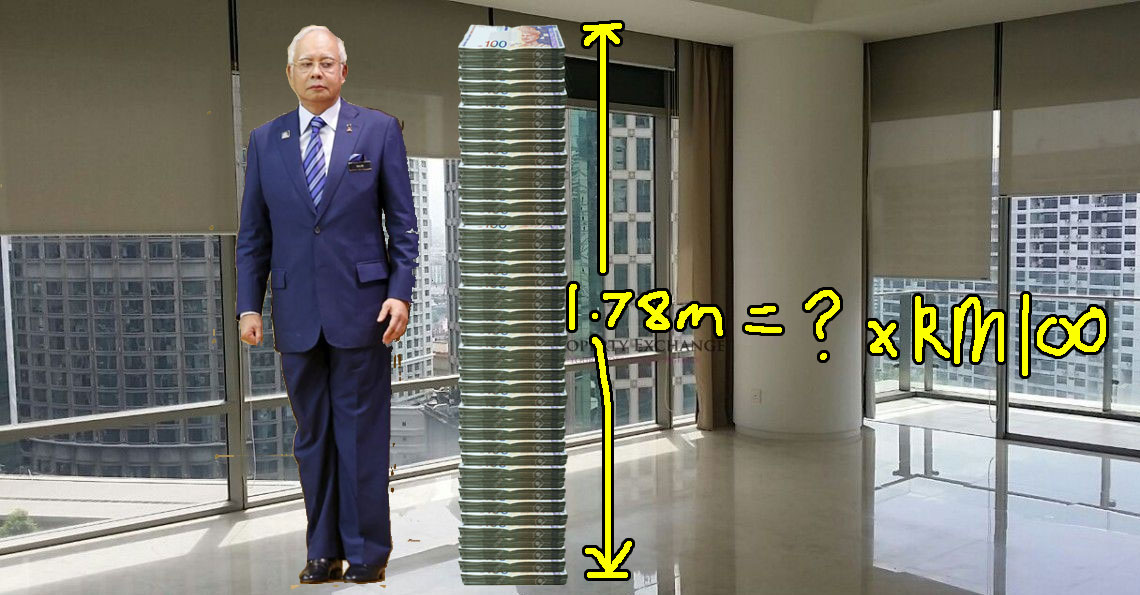

It takes about 15,000 RM100 notes to be as tall as Najib. How many Najibs to pay back the refunds ah?

Petronas will be giving a special RM30 billion to the govt, plus more dividends too

Img from our other article on Petronas.

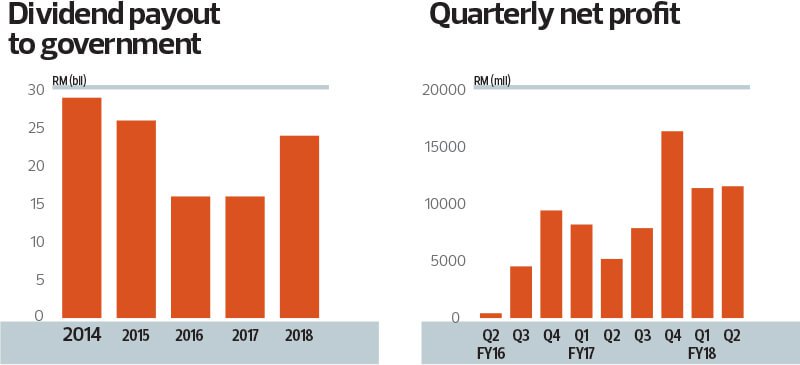

Some of you might not have known this, but because Petronas is the national energy firm owned by the Malaysian govt (and gets exclusive dibs on oil revenues), the company actually gives out a yearly dividend to the govt. In 2016 and 2017, Petronas handed back RM16 billion to the govt. For this year tho, with some, uh, debts to pay, Petronas will be giving RM24 billion back, which is an increase of 50%. On top of this increase in yearly dividend tho is a special one off payment from Petronas to help with the tax refunds – a whopping RM30 billion, bringing Petronas’ total contribution for the govt’s finances to RM54 billion for Budget 2019.

Petronas has also been doing better in recent times, which could explain the bigger dividend anyway. Their quarterly profits has been on the rise since 2016 (bar a small dip in 2017) and might be why the energy firm is more comfortable to pay more in yearly dividend. Besides, if you don’t factor in the special RM30 billion one off payment, it’s not even the most that Petronas has handed back to the govt in the past five years.

That being said, not everyone is a fan of Petronas funding the govt’s debt repayment – especially the RM30 billion extra payment. The opposition have criticised the move, with former Prime Minister Najib Razak worried that it would jeopardise the future of Petronas. Harapan MP Wong Chen also wasn’t pleased with the decision, arguing that while the tax refunds must be paid, this might not be the best time to raid Petronas’ savings for it, especially considering how prices can freefall anytime in the oil market.

“This worries me because we know there is a huge possibility Malaysia will be stuck in the trade war between US and China. If we use all the money now, the financial power of RM54 billion, we may run out of ‘financial bullets’ when the crisis really hits,” – Wong Chen, Subang MP, as quoted by Free Malaysia Today

That being said, politicians having differing opinions happens all the time. You could even argue that if our politicians all agree with the govt it’s probably a dictatorship. However, it might be something to take note of when Moody’s, an international group whose job it is to check the financial integrity of companies and countries, has a negative view on the govt taking Petronas’ money.

Moody’s has downgraded Petronas’ outlook, and might downgrade its credit rating soon

You know how if you want to buy a house, a bank assesses your credit history and financial record to see if you can afford the loan? Well, Moody’s kinda does the same thing, except it’s on a much bigger scale where they check the financial reputation and ‘creditworthiness’ of a company or country to see if it’s able to take on new loans or pay off their debts. You’re going to be wanting to get a good grade from Moody’s, with the grade ‘Aaa’ meaning that your company has low credit risk and able to pay off any short term debt easily. Having a good grade from Moody’s also means it would be easier to find investors for your corporation.

Apart from the credit rating, Moody’s also issues an ‘outlook score’, which is kinda like a hint at whether or not the future credit rating of a company or country would be going up or down. There are three types of outlooksgiven out by Moody’s, namely positive, stable and negative. A positive outlook means that in the next six months to two years, the credit rating might go up. Similarly, stable implies not likely to change and negativemeans that it might be lowered.

It’s here that Petronas finds itself in some trouble, as while their credit rating of A1 (fifth highest rating possible) has been affirmed, Moody’s has changed their outlook on Petronas from stable to negative. The main reason? That RM30 billion special payment plus increased dividend payment to the govt to help settle the tax refund issue.

“The negative outlook on PETRONAS’ ratings reflects our view that the financial profile of PETRONAS may deteriorate if the government continues to ask the company to keep dividend payments high, especially should oil prices decline,” – Vikas Halan, Moody’s Senior Vice President, as quoted by Moody’s

Remember: shareholders good, public bad.

This is on top of other concerns that Moody’s has regarding Petronas. Moody’s also seems to be mildly wary of the major shift in the Malaysian govt, as it is the first time the Putrajaya boat has been rocked. For example, the debate surrounding Harapan’s promise to increase oil royalties to oil-producing states remains an issue, with Prime Minister Mahathir recently saying that they’re backtracking on the promise to avoid putting too much burden on Petronas.

This means that there could be a good chance of Petronas’ credit rating being downgraded in the coming months, which would affect them negatively. Of course, you might wonder what’s the concern for you, the regular Malaysian, especially if you don’t work in Petronas. Here’s the thing tho: with Petronas already on a negative outlook, it might have its credit rating downgraded too.And if its credit rating is downgraded, thecountry’s credit rating could also be affected.

This is usually pretty bad, as when a country’s credit rating gets lower and lower, it becomes harder for the govt to raise funds by selling bonds. You wouldn’t invest in a bond that Moody’s classifies as junk right? That could mean the govt running out of money to spend on, well, the people. However, it seems as tho Malaysia might be in a safe place for now as Deputy International Trade and Industry Minister Ong Kian Ming has made it clear that they don’t intend to keep on using Petronas as a piggy bank in the years to come. Mahathir has also claimed that investors are returning to Malaysia in light of better treatment by the govt and less corruption.

“We do not expect Petronas to be paying a special dividend of RM30 billion in the next five years. (The investment) is something that we need in the short term to cover the shortfall; to pay back the GST and income tax refunds,” – Ong Kian Ming, Deputy International Trade and Industry Minister, as quoted by The Malaysian Reserve

Ong Kian Ming. Image from Free Malaysia Today

However, there is perhaps one question that remains which we might not be able to answer: is the RM54 billion payment from Petronas fair on the energy firm?

Petronas might be quite sien already of the govt taking its money

Well despite all the worry over the govt taking a chunk of Petronas’ accounts, it’s probably worth mentioning that this is far from the first time that the Malaysian govt has used Petronas to fund their spending.

In fact, we only need to go back to 2009 for the last time Petronas paid a dividend over RM30 million to the govt, which it did for three years straight up to 2011. A special report on Petronas by Reuters back in 2012meanwhile literally opens with the sentence ‘State-owned oil company Petronas is tired of being Malaysia’s cash trough’, further highlighting how Petronas often times finds itself having to bail out the govt.

“(Petronas) an oil company that prime ministers have treated as a piggy bank for pet projects since it was established in 1974. Interviews with current and former officials and an examination of Petronas and government documents show that strains have been building behind the scenes over how much money the company hands over to the government in the form of fuel subsidies, dividends and taxes,” – Reuters in 2012

That being said, there is some light at the end of for Petronas. As mentioned earlier, Ong Kian Ming has pointed out that the govt does intend to lessen the amount of money the govt takes from Petronas once the tax refund issue is done and dusted. On top of that, Wong Chen – the Harapan MP unhappy with the special payment – has come out to remind the govt that it promised in its GE14 manifesto that Petronas should report to the Parliament, and not the Prime Minister. He also added that the wants the govt to amend Petroleum Development Act 1974 to give Petronas back to the Dewan Rakyat.

If all things go the way it’s been planned, this might be the end of the tax refund issue as well as the beginning of a good time for Petronas.

https://cilisos.my

✍ Sumber Pautan : ☕ Malaysians Must Know the TRUTH

Kredit kepada pemilik laman asal dan sekira berminat untuk meneruskan bacaan sila klik link atau copy paste ke web server : https://ift.tt/2KbVg7g

(✿◠‿◠)✌ Mukah Pages : Pautan Viral Media Sensasi Tanpa Henti. Memuat-naik beraneka jenis artikel menarik setiap detik tanpa henti dari pelbagai sumber. Selamat membaca dan jangan lupa untuk 👍 Like & 💕 Share di media sosial anda!

Post a Comment