Yoursay: Is the capital gains tax really a good idea?

YOURSAY | ‘Will the CGT be on net profits? That is, minus losses when selling lower.’

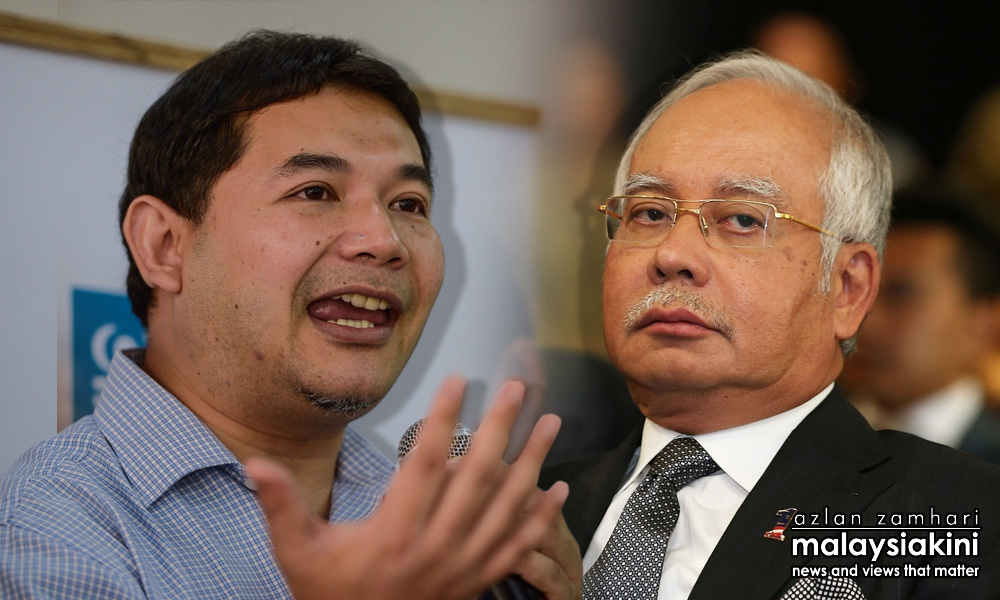

Taxing profits from shares fairer than GST, Rafizi tells Najib

The Wakandan: If people are making a profit, then it will not hurt them so much to be taxed on it compared to being taxed for all goods like in Goods and Services Tax (GST).

The Wakandan: If people are making a profit, then it will not hurt them so much to be taxed on it compared to being taxed for all goods like in Goods and Services Tax (GST).

The fear here is that investors will not invest in our shares domestically because they will be taxed on their profits. That is to be seen but if tax is required to generate revenue, then we have to take the lesser devil.

But please, do not steal from the coffers. That would be the worst for the country.

Andysee: It's very simple. If someone makes profits through share trading, that person should be taxed, just like companies that make profits.

It's fairer than GST, which taxes everyone whether they make profits or not, and whether they are struggling or not.

It's fairer than GST, which taxes everyone whether they make profits or not, and whether they are struggling or not.

SAC: Yes, Rafizi is correct. capital gains tax (CGT) is the way forward. Why must those trading shares and profiting from it be exempted?

Anonymous_1404366050: Shares players are classified as risk-takers. This group of people have resources and means. It's not for poor people.

So, the risk-takers should be prepared to pay.

Anonymous_1404366050: Shares players are classified as risk-takers. This group of people have resources and means. It's not for poor people.

So, the risk-takers should be prepared to pay.

Ipoh PP: What is the quantum of tax, period of holding and percentage of tax? It’s not such a simple tax.

What if a person has held the shares for more than three years? What if when I sell some shares and I have made a loss? Will the government reimburse me for my loss?

If CGT is imposed, I am out of the market and will trade via Singapore which has no such tax. Think very carefully when imposing this tax.

Save Our Currency: Will the CGT be on net profits? That is, minus losses when selling lower. Will it be put into the central depository accounting system with annual statement and taxed at source?

What about period of holding? Perhaps shares held over longer periods may be waived from this tax and that would rule out speculation in Bursa Malaysia.

Anonymous 2404711458006460: If CGT on sale of shares is introduced, will it allow for accumulated losses on non-profitable share transactions to be netted off against the profitable ones?

If not, it really doesn't make sense to look at individual transactions that make money when people have lost on many other stocks.

Straight-Talk: Impose CGT to get extra revenue, but it must work both ways - tax if there are gains and reimburse if the seller suffers losses.

AK: To be honest, most retailers do not make much money from the stock market. The ones who gain are the big funds like the Employees Provident Fund (EPF) and Khazanah Nasional as well as other big foreign funds.

Eventually, everybody has to bear such taxes in the form of lower dividends. Many emerging markets don’t impose CGT. Unlike developed markets where most ordinary people invest in unit trusts, people here in Malaysia tend to buy directly through brokers and gamble in casinos.

Imagine the bureaucracy involved in imposing such taxes.

Gaji Buta: It is always the same group of people who end up being taxed. Please also look into how to tax the hundreds of thousands of roadside hawkers and family-run businesses, who have not paid taxes since independence.

Or just bring back GST!

Anon: I agree with Gaji Buta. It is always the wage earners who suffer. More so now if they even think of growing their savings by investing.

Whereas the warungs, self-employed, etc, get off scot-free.

Whereas the warungs, self-employed, etc, get off scot-free.

Anonymous_1527925538: Shares represent ownership of companies and these companies already pay corporate tax to the government. Why tax the shareholders again? This is not fair.

Anonymous #40538199: Instead of coming up with more new taxes, I think it is better if the government brings back GST at a lower rate with more zero-rated items, so that filing taxes would be simpler for ordinary folks.

Just provide an efficient refund mechanism so that businesses need not price in the non-refundable GST.

Just provide an efficient refund mechanism so that businesses need not price in the non-refundable GST.

I think the government needs to cut expenses in order to put more money into businesses and the people. After all, the private sector (businesses and individuals) is more efficient in spending the money and generating higher multiplier effects than the public sector.

Please don't impose taxes which are only appropriate for an advanced economy.

Kamaru: Imposing capital gain tax for an emerging market will sink the Kuala Lumpur Composite Index (KLCI) to the bottom of the deep blue sea. Don't even contemplate it.

Aaron Han: If Malaysia implements CGT on shares, foreign fund managers will not buy shares via Bursa Malaysia; they can buy shares through the Singapore stock exchange which is not taxable.

All brokers in Malaysia will then lose out share investment businesses to Singapore.

Vinc: Luckily Rafizi isn't the finance minister. He may be an accountant, but I doubt his business acumen.

CGT for shares investments is like killing the golden goose for its eggs.

Lebai Pencen: I am willing to sacrifice and pay more taxes if it is reasonable and ensures that the right people are made to sacrifice and not the nasi lemak seller and those like him/her. -Mkini

✍ Sumber Pautan : ☕ Malaysians Must Know the TRUTH

Kredit kepada pemilik laman asal dan sekira berminat untuk meneruskan bacaan sila klik link atau copy paste ke web server : https://ift.tt/2OpwsxV

(✿◠‿◠)✌ Mukah Pages : Pautan Viral Media Sensasi Tanpa Henti. Memuat-naik beraneka jenis artikel menarik setiap detik tanpa henti dari pelbagai sumber. Selamat membaca dan jangan lupa untuk 👍 Like & 💕 Share di media sosial anda!

Post a Comment