Offshore funds linked to 1MDB scandal also involved in Indian, Russian frauds

PANDORA PAPERS | Offshore funds involved in moving money misappropriated from 1MDB were found to be tied to high-profile frauds in India and Russia, checks by Malaysiakini as part of a joint investigation with the International Consortium of Investigative Journalists (ICIJ) found.

The two Curacao-based investment funds - Enterprise Emerging Markets Fund BV (EMMF) and Cistenique Investment Fund BV - were involved in transferring US$455 million (RM1.49 billion) misappropriated from 1MDB from 2012 to 2013.

The funds were involved in two parts of the 1MDB scam - first by siphoning off part of US$3.5 billion (RM11.2 billion based on the exchange rate then) raised through government-backed bonds in 2012, and transferring the stolen cash to a company owned by Jho Low associate, Eric Tan Kim Loong.

Eric Tan Kim Loong, a Jho Low associate.

In the second part, they were part of four companies involved in creaming off US$1.59 billion (RM5.32 billion) from bonds raised with the help of investment bank Goldman Sachs in 2013.

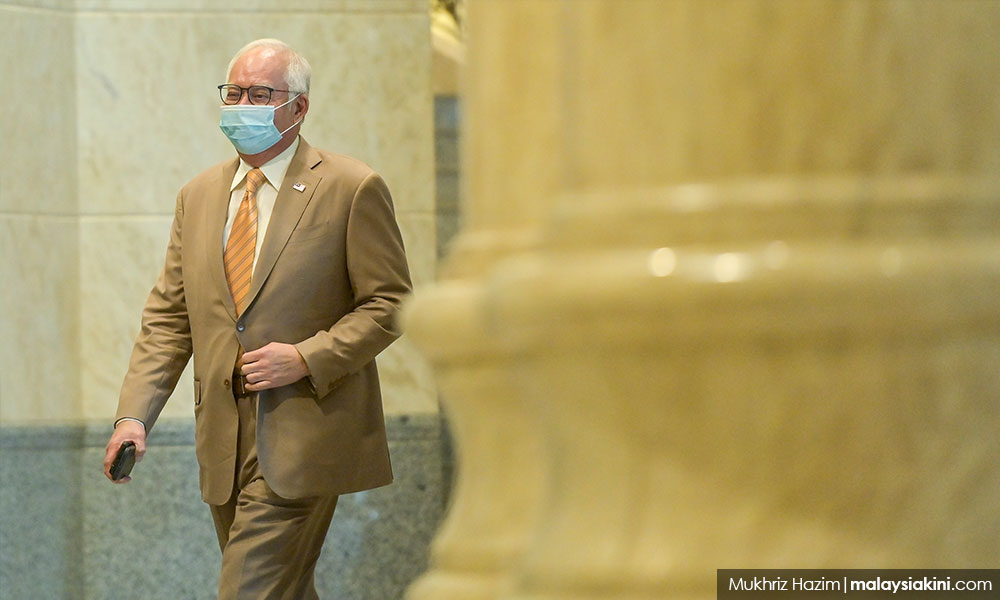

Some US$681 million (RM2.28 billion) of that money ended up in former premier Najib Abdul Razak’s personal bank account, the United States Department of Justice (DOJ) said.

Najib denies any wrongdoing while his legal team has contended that he was misled by others.

The link between 1MDB and high-profile scandals in Russia was found following Malaysiakini’s search on companies linked to the 1MDB scandal in the Pandora Papers.

The Pandora Papers refers to a trove of documents leaked to ICIJ and its partners, originating from firms that provide services to those seeking to set up or manage offshore trusts and companies in tax havens.

The link was discovered through a cache of documents leaked from Aleman, Cordero, Galindo & Lee (Algocal), a leading Panama law firm.

However, the reason the Russian scandal caught Algocal’s attention was not revealed in the Pandora Papers.

What is clear, however, is that EEMF and Cistenique were allegedly part of the Indian and Russian scandals between 2009 and 2015, the same time period the 1MDB scandal took place.

Yet despite their wide-ranging involvement in allegedly facilitating various billion-dollar international financial frauds, the individuals behind EEMF and Cistenique are not facing any charges, while their identities remain a mystery.

Russian bank scam

The roles played by EEMF and Cistenique in the Indian and Russian frauds range from alleged involvement in transferring funds to having shares in companies allegedly involved in frauds.

In Russia, the two investment funds were reported to be linked to the embezzlement of US$2 billion (RM8.28 billion) by its founder Larisa Markus, which resulted in the closure of Russian bank Vneshprombank (Foreign Economic Industrial Bank) in 2016.

EEMF and Cistenique were both major shareholders of Vneshprombank, which was at the heart of one of the country's largest bank frauds. EEMF held 12.52 percent while Cistenique held 9.85 percent stake in Vneshprombank.

READ MORE: How Daim, M'sia's uber-rich use S'pore to store money offshore

Founded in 1995, Vneshprombank was one of Russia’s top mid-tier banks by 2014 and earned a reputation for being a VIP bank.

In 2015, Forbes Russia reported that the bank's clients included the wives of then deputy prime minister Dmitry Kozak and defence minister Sergei Shoigu.

When uncovering the fraud, Russian authorities said Markus and Georgy Bedzhamov, her brother and Vneshprombank’s co-owner, had issued loans to 286 shell companies with no intention of recovering them.

According to Russia’s deposit insurance agency, fraudulent loans totalled 23 percent of the bank’s loan book.

Footprints in several Indian ruses

In India, the EEMF were linked to several scandals.

Most well-known was the 134 billion rupees (RM7.4 billion) money laundering case and fraud through fraudulent letters of undertakings involving businessperson Nirav Modi (no relation to Prime Minister Narendra Modi).

Nirav Modi was a jeweller featured in the Netflix documentary series Bad Boy Billionaires: India, where he was shown to be exiled in London due to a crackdown on his fraudulent activities.

India’s anti-money laundering agency found money transfers from EEMF to a few family firms of Nirav Modi, the Indian Express reported. He is appealing an extradition order.

Separately, Mumbai Police found EEMF footprints in a probe into defaults of Foreign Currency Convertible Bonds worth US$125 million (RM393.75 million) in 2013.

The probe found that at least US$82.02 million (RM343.97 million) of the money raised were invested in EEMF by Geodesic’s wholly-owned Hong Kong subsidiary, Geodesic Technology Solutions Limited, in 2010-2011.

In a charge sheet in April 2016, the Mumbai Police said ex-directors of Geodesic had “acquired shell companies” in tax haven jurisdictions and invested a portion of the net proceeds of the bonds “through EEMF with the intent to siphon off the net proceeds and defraud the bondholders”.

EEMF is also linked to a Directorate of Revenue Intelligence investigation into Indian multinational conglomerate and construction corporation Essar Group.

The authorities alleged that Essar Global Limited, the holding company of Essar Group businesses, had overvalued power equipment imported by four Essar Group companies.

The inflated invoices for the equipment were allegedly issued by an intermediary, Global Supplies (UAE) FZE, owned by Cyprus-based Seppest Holdings, which was in turn owned by EEMF.

The Essar Group has denied the allegations of inflating the value of the imported capital equipment.

Sources said while EEMF’s name has cropped up in each of these cases, the Indian investigative agencies have not named EEMF as an accused in any of these cases.

EEMF and Cistenique liquidated

To date, the United States DOJ has not said if any action or investigation is undertaken against EEMF and Cistenique for their roles in the 1MDB scandal.

The DOJ declined to comment when Malaysiakini enquired if any action had been taken or planned against the two investment funds.

Both EEMF and Cistenique were reported to be in liquidation as of July 2017, with no indication if any proceeds made through the 1MDB scandal to be recovered.

Najib was on July 27, 2020, found guilty by the High Court in Kuala Lumpur for abuse of power, criminal breach of trust, and money laundering involving RM42 million in funds from SRC International Sdn Bhd.

SRC International was a former subsidiary of 1MDB before it was fully owned by the Minister of Finance Incorporated (MoF Inc).

Najib was then the chairperson of 1MDB's board of advisors, SRC International’s advisor emeritus as well as finance minister.

He has denied involvement and knowledge concerning the RM42 million and is appealing the conviction.

He is also currently facing trial over four charges of power abuse to obtain bribes totalling RM2.28 billion from 1MDB and 21 charges of money laundering involving the same amount.

Najib’s defence team contend that former 1MDB CEO Mohd Hazem Abdul Rahman acted together with Jho Low and his associates to misled the former prime minister.

This article is part of the international coverage of the Pandora Papers. - Mkini

✍ Credit given to the original owner of this post : ☕ Malaysians Must Know the TRUTH

🌐 Hit This Link To Find Out More On Their Articles...🏄🏻♀️ Enjoy Surfing!

Post a Comment