Losing Money In Stock Market? Its Najib’s Fault – Here’s The Proof

Since December 2008, Malaysia stock market has more than doubled (up 88% in U.S. dollar terms), until a “disaster strikes” the country. In fact, the rally in the Malaysian shares was the world’s longest bull market. Comparing to other stock markets, the KLCI (Kuala Lumpur Composite Index) has gone up the longest without a 20% correction.

The KLCI almost breached the 20% correction last year when at one point it was down 18%. Technically, a 20% correction would represent the end of a bull market and the start of a bear market. The world’s second longest Bull Run belongs to U.S. S&P500, where it has been in the bull market since March 2009, roughly 4 months less than Malaysia.

The S&P500 was thought to be crashing this year when it went down as much as 10%. But it has since recovered. If S&P500 continues to charge while KLCI retreats this year, the U.S. stock market will essentially become the world’s longest bull market. So, what was the disaster which has stopped the Malaysia stock market from rallying?

Depending on whom you speak to, two factors are being used as punching bag for the collapsing KLCI, which started since late 2014. Malaysia Prime Minister Najib Razak will conveniently blame it on crude oil prices, of which he would say is beyond his control. Critics, however, will blame Najib’s RM42 billion 1MDB scandal, which has since spread like wildfire.

Actually, Malaysian shares would have had suffered a more serious crash, if not for the fact that its shares (and stock markets of Indonesia and Thailand for that matter) are made of defensive sectors. “Defensive” sectors – healthcare, utilities, telecoms, consumer staples – are traditionally less sensitive to an economic slowdown.

In comparison, defensive sectors make up 37.6% of the Kuala Lumpur Composite Index, whereas the same sectors make up just 10.2% of Taiwan’s stock market, and 20.2% of South Korea’s. Hong Kong and China’s defensive sectors command only 17.2% and 14.1% respectively while Indonesia has the highest percentage of defensive sectors at 42%.

Besides defensive sectors, the compelling reason KLCI was shielded from a total collapse like the one seen in the 1997-1998 Asia Financial Crisis is the relatively low foreign money in the local stock market. After the (1997) financial crisis, the Malaysian stock market is being run like a casino by local institutions such as the Employees Provident Fund (EPF).

EPF alone accounted for almost half of the total market value of traded shares, compared with 29% for foreign funds. Managing over US$170 billion (£129 billion; RM685 billion) in assets, clearly EPF is a major shareholder of many Malaysian public companies. EPF single-handedly supports KLCI from crashing, despite the biggest corruption – 1MDB – in the history of Malaysia.

But even with 37.6% defensive stocks and splashing hundreds of billions of ringgit supporting the local stocks, PM Najib Razak’s 1MDB scandal proves to be too massive and too ugly to be ignored. Here’re two proof showing that the ailing KLCI is the fault of Najib Razak and his extremely corrupted government – not the tumbling of crude oil prices alone.

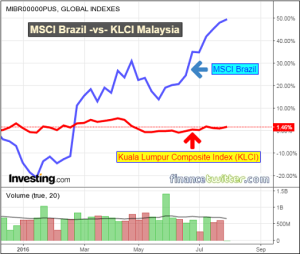

The MSCI Emerging Markets Index, which covers 23 emerging markets, is up 11% year-to-date while the Kuala Lumpur Composite Index (KLCI) is only up 5% so far this year. Usually, Malaysian stocks move in unison with other emerging markets. However, since the beginning of last year, while emerging markets are down 8%, Malaysian shares are down 18%.

Comparing KLCI with MSCI Emerging Markets Index is the nearest (and best) we can get because factors that affect the Malaysian market are the same factors that drive global emerging markets, such as commodity prices, the strength of the U.S. dollar and investor sentiment towards emerging markets.

Still not convinced? Here’s the second proof that the present bearish KLCI is due to (1MDB) corruption, not sagging crude oil. Brazil is the world’s 12th largest oil producer and the biggest oil producing country in South America (2.95 million barrels per day in 2014), follows by Mexico (2.8 million barrels per day) and Venezuela (2.7 million barrels per day).

Like Malaysia, Brazil was experiencing its own version of corruption. If Malaysia was struck with 1MDB, Brazil has its own “Operation Car Wash”. Brazil’s corruption scandal was so devastating that not only it involved former President Luiz Inacio Lula da Silva but roughly 50 politicians, including the heads of Brazil’s senate and lower house.

The Brazil corruption scandal involved money laundering to the tune of 10 billion Brazilian Reals (US$3.1 billion; £2.4 billion; RM12 billion). Its national oil producer Petrobras was also the target of corruption probes by the U.S. Securities and Exchange Commission and the U.S. Department of Justice. Likewise, US-DOJ announced over US$3.5 billion was stolen from Malaysia 1MDB fund.

Unlike Malaysia, however, Brazil launched aggressive investigations of implicated officials when the scandal broke. Even Brazilian President Dilma Rousseff was suspended from office pending an impeachment trial over accusations that she illegally manipulated government accounts.

Brazil’s economy is going through its worst recession in more than three decades following a drop in prices for Brazilian commodities such as oil, iron ore and soya. Last year, the country’s economy shrank by 3.8%, its worst annual performance since 1981. Inflation reached a 12-year-high of 10.7% end of last year, while unemployment skyrocketed to 9% in 2015.

Obviously, Brazil’s economy is worse than Malaysia’s. But its stock market, one of the best-performing emerging markets of the year so far, has rallied by 87% in U.S. dollar terms from its January low, the same month the country’s president was arrested. In contrast, Malaysia’s government is still officially denying that anything is amiss.

PM Najib Razak shamelessly denies he has anything to do with 1MDB scandal, which the US-DOJ calls the biggest money laundering ever brought under the Kleptocracy Asset Recovery Initiative. It was also the largest money laundering probe Singapore has ever undertaken, not to mention investigations are ongoing in at least 6 countries around the world.

Looking at the MSCI Brazil vs. KLCI Malaysia performance chart, was it a coincidence that the Brazil stock market jumped more than 80% after the arrest of its top officials over the country’s corruption scandal? Absolutely not! Brazil’s stock market successfully regains investors’ confidence because the country’s judiciary and law enforcers are still functioning.

Malaysia, on the other hand, is no different than North Korea or Zimbabwe where its leaders Kim Jong-un and Robert Mugabe can practically steal, oppress, suppress, threaten and even kill anyone who dares to question the corrupt leaders. Therefore, it’s not exaggerate to say that Najib Razak is to blame if one losses money due to Malaysia’s sagging stock market.

Otherwise how do you explain Brazil, a country that was hit by tumbling oil prices and mega corruption, is experiencing a stock market rally of more than 80% the moment the corrupt top leaders were arrested and suspended from office? There’s only one way to prove that KLCI can skyrocket like MSCI Brazil. But who dares to arrest, let alone charge PM Najib Razak?

Other Articles That May Interest You …

- First Family’s Monkey Report On FBI Conspiracy Has Backfired Spectacularly

- Here’s How MO1 Can “Donate” To US – “Secretly” – To Cover His 1MDB Scandal

- Congrats Najib, Your Boy Has Just Proven Your Family Has Everything To Hide

- Here’s Why U.S. Uses “Malaysian Official 1” To Link PM Najib To Stolen Money

- Riza Aziz’s London Mansion – UK Is “Fantastically Corrupt” For Doing Nothing

- WSJ’s Last Bombshell For The Year – Najib’s $700 Million Came From 1MDB

- One Big Family Of Crooks? Najib’s In-Law Took Hermes Bags Without Paying

- If The US Really Wants To Put Najib On Trial, There’s No Escape

- Flashback Of 1997 & Today’s Financial Crisis – Here’s Why You Should Be Scared

- A Remaking Of 1997 Asian Financial Crisis By Najib Razak In 2015

- Here’re 14 Crazy Facts How Huge (1MDB) RM42 Billion Debt Is

from FinanceTwitter http://www.financetwitter.com/2016/08/losing-money-in-stock-market-its-najibs-fault-here-the-proof.html

Post a Comment